Paul J. Mauro practices estate law at Legacy Financial Advisors. Here are a few steps to take to avoid problems he encounters regularly.

- Please make sure your name, birthday and social security number are all the same on all your documents, records and papers. In one case a wonderful man passed away and we went to file claims with his pension, social security and insurance companies. When a copy of the death certificate and the birth certificate were laid side by side, guess what, different birthdates were listed. Different dates of birth, or in another case, a different birth name which was dropped 30 years ago can lead to long delays and costs to prove real identity. The stress that widows and widowers have is NOT reduced by this type of hanging issue. In fact it makes things very tense. Please check and be sure on all your important papers that the dates and names match up.

- The probate process may seem like no big deal when we look back to the passing of our parents and grandparents who did not have much. Now with larger estates more complete data from Internet databases and many long lost relatives on the web, it gets more serious. If you own a home in your state but you have a cottage, mountain house, or camp in a faraway place, your family will have not one state probate, but two. In many cases the rules of that other state are totally and completely different than your home state. This process requires your family to obtain outside counsel in that state, make required filings and yes, wait and wait. The land, which may have little value, can often cost many thousands to get released from probate to sell or dispose of. Real estate is the primary reason to do revocable trust work late in life so children can legally avoid the costs and hassles of probate.

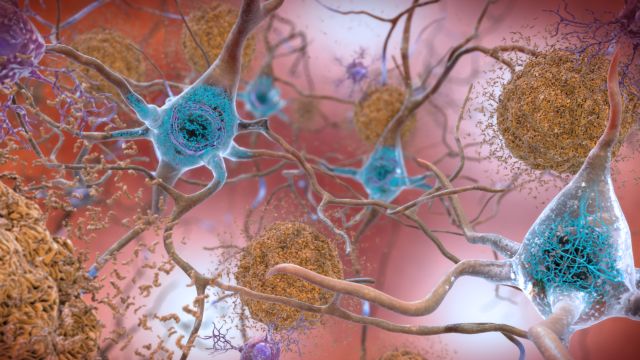

- When we age, often there is a period of time that we cannot deal with our financial affairs and family has to take over. I worked with a family who did not prepare in advance until Alzheimer’s took over the life of the family matriarch. The problem in this family is that the husband was a very successful scientist with a huge laboratory tied to one of the fine Massachusetts educational institutions. As a result, he had a multi-million dollar retirement fund for which he is required at age 80 to take minimum withdrawals. The problem is, under the plan rules of his former employer, he could take withdrawals without his wives notarized signature, and his wife could sign. When we had the telephone consultation with the company they told us the old power of attorney will not suffice, and to take your withdrawal so we will not release the money. The plan administrator was very polite and told our firm’s lawyer that this fellow would just have to go to court and get a guardianship of conservancy over his wife. That, ladies and gentlemen means going to probate. This man tried to play by the rules but his wife got sick and so he had a 50% tax penalty for not taking his required minimum distribution and his retirement account is basically held hostage while we go to court. Please update your legal documents, roll over your employer plan to your own IRA for control and make sure you have the right papers to control your spouse’s retirement if they become disabled.

- Ladies please be clear about the jewelry. I know it sounds like a small thing, but a family I have known for decades was fractured over a diamond ring because one daughter took it home. With five children and plenty of money in the estate, these parents left a large inheritance. In the end however, one daughter (of 3) and two boys were upset with each other over this one small thing. Most wills and trusts provide space for the memorandum to list clearly who gets what of material goods like clothes, jewelry and furnishings. Some instructions remove assumptions and bad feelings. Naturally when there is one ring and 5 children decisions have to be made. If you have personal items, especially of large monetary value, make a list and attach to your will or trust.

- Boys and their toys are not a big issue during life. Men have car collections, tool collections and even stamps and coins. For some reason men collect things that they enjoy, but when they pass away, the wives are stuck with a monumental cleanup job. I once liquidated an estate with a huge number of tools and wood working materials the spouse would never use. There was a car collection and automobile tools she was never going to touch. This man was a collector of things and he never had one, he had three. Just thinking about where the collection would go and how to get it to the auctioneer and turn the toys into cash was a giant job. So if you love your spouse, leave a guidebook, a set of instructions or a wish list. Do you want the tools to go to a tech school? Let us know. Is there some place we can call to sell the rare wood? These are things we need to know.

In summary, a few pieces of paper, a road map and some instructions would be nice. Since we all collect more things over time, take a few minutes to plan where and how your family will handle these things when you’re gone. This way we can remember our loved one for the good times and the great memories, not the hassles of cleaning out their junk.

SOURCE:

Paul J. Mauro, Legacy Financial Advisors, Inc.

Thank you very much!! I'm sharing this post with my facebook group.

Thanks for this Marie!

Great post and tips. My thoughts are with anyone who has a parent or parents with dementia. My mother was diagnosed with dementia and although it wasn't a complete shock to us, because we knew something was wrong, it rocked our worlds. Ever since her diagnosis my siblings, father and I have been trying to read all we can about it and how other people are dealing with it. I just finished a great book that I'd like to recommend to anyone else going through this same ordeal; it's called "I Will Never Forget" by Elaine C. Pereira. You can check her and the book out on her website http://elainecpereira.authorsxpress.com/. It was a really great read. Thanks for this post!